Settle in Canada

Citizenship Requirements

Changes to Canadian citizenship legislation went into effect at the end of 2017, resulting in a smoother and speedier application procedure.

To become a Canadian citizen, permanent residents must meet the following criteria:

- Have lived in Canada for three years (1,095 days) during the five years before you sign and submit your citizenship application. Days physically spent in Canada as a student, visitor, worker, temporary resident, or protected person within the last five years may be used to count one-half day, up to 365 days, toward the 1,095-day total.

- Meet the minimum language requirements in either English or French. Applicants between the ages of 18 and 54 will be required to show proof of their language proficiency.

- Possess basic knowledge of a Canadian citizen’s rights and responsibilities and knowledge of Canadian history, geography, and political system to pass the Canadian citizen test once their application is approved.

- Must not have a criminal history that will prohibit the granting of Canadian citizenship.

To become a Canadian citizen, minors under the age of 18 who are permanent residents are not required to have been in Canada for three years (1,095 days).

Having dual citizenship in Canada means that you will keep your old nationality. However, residents who aspire to become Canadian citizens should ensure that their present country of citizenship recognizes dual or multiple citizenships before applying for citizenship in Canada.

If you meet the eligibility requirements, you can apply anytime you desire citizenship. Unlike permanent resident programs, there are no application deadlines that need to be followed.

A half-day is counted for every day spent in Canada as a temporary resident (student, visitor, worker, or protected person). The 1,095-day criterion can be met by using up to 365 days of the applicant’s time.

Life in Canada

Canada is the second-largest country in the world. More than 80% of Canadians live in big cities, yet most residents live within 100 kilometers of the southern border. Canadians have one of the highest living standards globally and rank in the top ten for the world’s happiest country.

Overwhelming it might be to relocate to a new country from your current one. For both permanent residents and temporary foreign workers, there are things you can do to smooth the transition, such as preparing crucial documentation and securing a place to live once you arrive. If you’re traveling to Canada, you’ll want to have the following items with you:

• Your passport,

• Birth certificate,

• Marriage certificate,

• Driver’s license, and

• Any relevant academic certificates and diplomas.

Make sure to keep in mind that certified translations in either English or French may be required from time to time. If a translation is needed, it should be performed in the same country as the original document was issued.

That doesn’t mean you can’t find a temporary somewhere to stay before you make the significant move. Temporary accommodation may be necessary if no family or friends can host you upon arrival. While you’re looking for a permanent residence, you can explore the city while staying in a temporary residence.

Once you get to Canada, there are some essential items to get in order:

1. Getting your Social Insurance Number

2. Opening a Bank Account

3. Getting a Driver’s License

4. Looking for Work

Primary, intermediate, and post-secondary education are part of Canada’s educational system. Provincial funding for Canada’s education system means that education systems vary widely from province to province. Attending school in Canada is a legal requirement for all children under 18.

However, the age at which students are required to attend school varies slightly from province to province. All children in Canada must attend school between the ages of five and eighteen.

To put it simply, Canada is one of the world’s wealthiest countries. Two-thirds of the economy comprises the service sector, while key exports include petroleum and natural gas. U.S. citizens and permanent residents benefit Canada because the United States is Canada’s most important trading partner. When it comes to the Canadian economy, there is a wide variation between provinces and territories, as each has a unique mix of resources.

Depending on where you live in Canada, you may be subject to taxation from January 1st to December 31st. You must file a tax return if you live in Canada by the April 30th deadline. You must include all of your money, regardless of where it comes from.

Canada is home to some of the world’s top services for new immigrants. It’s a wide range of services aimed at helping new immigrants find homes and employment, enhance their language skills, file taxes, enroll kids in school, and more. The federal and provincial governments support all these initiatives, but they fluctuate from one province to another.

Economic Resources of Canada

Each province and territory in Canada has its distinct economy, influenced by various factors. Western provinces produce more oil, lumber, and metals, whereas the prairie provinces create more energy, industrial goods, and farm products; eastern provinces produce more energy, automobiles, consumer goods, etc.

Private and public businesses coexist in Canada’s economy. The term “private enterprise” refers to businesses owned and operated by individuals rather than the government. Canada’s public firms, sometimes known as Crown corporations, have either been directly or indirectly controlled by the government of Canada.

However, this is the lowest rate of unemployment that Canada has seen since February 2008, putting it in the middle of the pack among G20 countries in terms of unemployment.

The service sector makes up two-thirds of the economy. Real estate, manufacturing, and natural resources are also significant sectors of the economy.

I. Natural Resources

II. Information & Communications Technology (ICT)

III. Agriculture and Foods

IV. International Trade

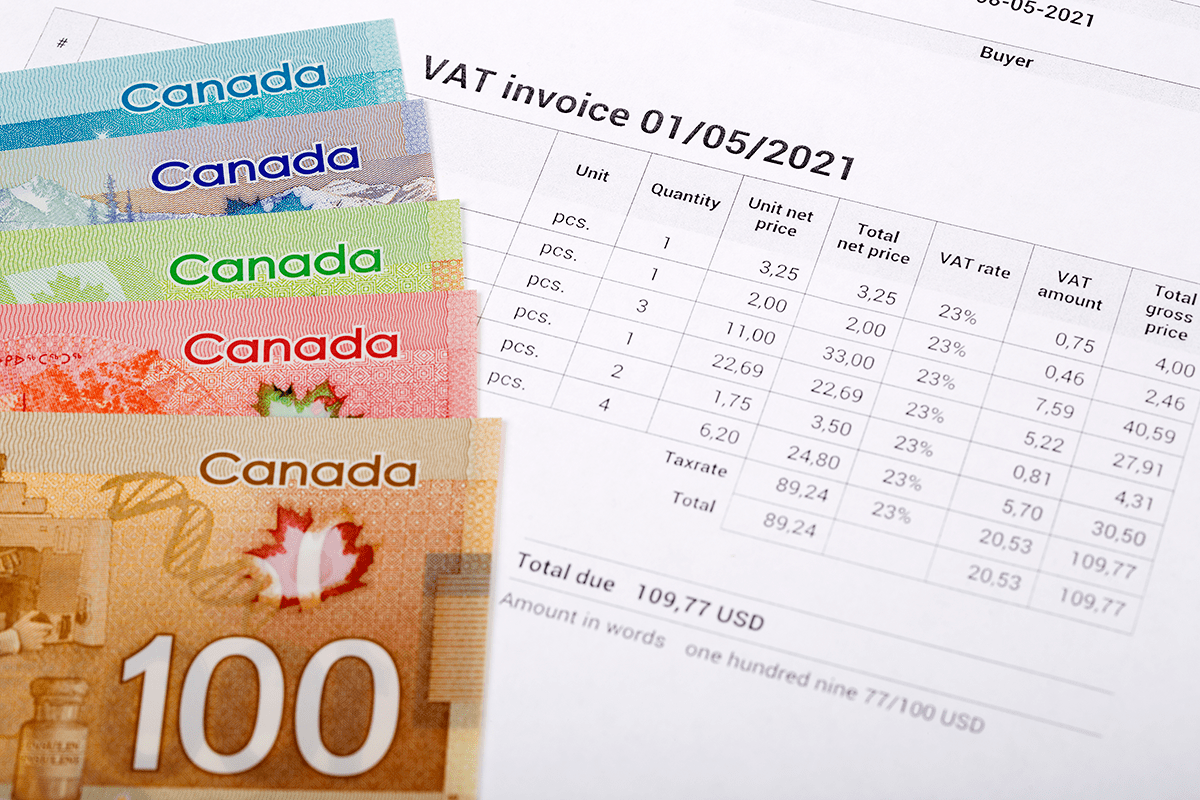

Taxation in Canada

Many public health and social services in Canada are funded via a comprehensive taxation structure. Compared to other countries in the Organization for Economic Cooperation and Development (OECD), Canada has lower taxes than the average. As a result, Canadians pay less in taxes than their counterparts in France, Germany, New Zealand, the United Kingdom, and other countries.

To name just a few, the country levies taxes on everything from income to sales to the property to corporations. Canada’s federal government relies heavily on income tax revenue. In reality, the federal government receives around half of its funding from this source. A combined fifteen percent of federal revenue comes from corporate and sales taxes.

• System of Taxation

• Taxes on real estate

• Taxation of Corporations

• Taxes on goods and services

• Services for Newcomers

Newcomers Services

Canada is home to some of the world’s top services for new immigrants. It’s a wide range of services aimed at helping new immigrants find homes and employment and enhancing their language skills, and more. Programs financed by the federal and provincial governments are available in a variety of ways, including but not limited to:

• Housing and Accommodations, • Employment Services, • Education for Children, • Language Training, • Services for International Students

Once you’ve made your plans to settle in Canada, you’ll need to find a place to stay. Even if you’re feeling overwhelmed right now, you should know that there are a variety of tools at your disposal to assist you!

There are several options available to newcomers, including:

• Subletting: typically occurs when a renter is out of town to return to the same apartment/house for a certain period.

• Renting: You can also choose to rent an apartment. As a renter, you are required to pay the landlord/owner every month for your stay and abide by the rules agreed upon in the lease.

• Ownership: When you’re ready, buying a house can complete your transition to Canada. For most newcomers purchasing a home doesn’t happen within the first year, and some Canadians may choose always to rent rather than buy.

Students from other countries who need housing Students from throughout the world can take advantage of these services, which include:

• On-Campus Housing

• Off-Campus Housing